Master Limited Partnerships are limited by US Code to only apply to enterprises that engage in certain businesses, mostly pertaining to the use of natural resources, such as petroleum and natural gas extraction and transportation. Some real estate enterprises may also qualify as MLPs. To qualify for MLP status, a partnership must generate at least 90 percent of its income from what the Internal Revenue Service (IRS) deems "qualifying" sources. For many MLPs, these include all manner of activities related to the production, processing or transportation of oil, natural gas and coal.

Some private equity management companies such as Blackstone Group (NYSE: BX) and Fortress Investment Group (NYSE: FIG) are structured as MLPs.

In practice, MLPs pay their investors through quarterly required distributions (QRD), the amount of which is stated in the contract between the limited partners (the investors) and the general partner (the managers or GP). Typically, the higher the quarterly distributions paid to LP unitholders, the higher the management fee paid to the GP. The idea is that the GP has an incentive to try to boost distributions through pursuing income-accretive acquisitions and organic growth projects. Failure to pay the QRD may constitute an event of default.

Because of such stringent provisions on MLPs, and the nature of the QRD, the vast majority of MLPs are pipeline businesses, which earn very stable income from the transport of oil, gasoline or natural gas.

Because MLPs are a partnership, they avoid the corporate income tax, on both a state and federal basis. Additionally, the limited partner (investor) may also record a pro-rated share of the MLP's depreciation on his or her own tax forms to reduce liability. This is the primary benefit of MLPs and gives MLPs relatively cheap funding costs.

However, this makes MLPs unattractive to tax-deferred funds, who must lose this tax saving advantage. To encourage tax-deferred investors, many MLPs set up corporation holding companies of LP claims which can issue common equity.

An example is the pipeline company Kinder Morgan Energy Partners. The main corporation, Knight, Inc. (formerly traded on the NYSE as KMI), is the operator of the pipelines and other assets. However, the pipelines themselves are owned by the MLP Kinder Morgan Energy Partners, L.P. (NYSE:KMP). Finally, part of KMP's limited partner interests are held by the corporation Kinder Morgan Management LLC (NYSE:KMR) which allows tax-deferred investors to participate in KMP's operations.

Usually, in the MLP structure, the general partner starts with a small (usually 2%) stake in the company but is given incentive distributions from net income after the QRD. Since these distributions are usually paid in the form of increased equity claims, over time, this allows the general partner to attain higher and higher percentage of ownership in the company. In May 2010, the first ever MLP mutual fund was launched, with a stated goal of providing "a high level of inflation-protected income currently through a 7.8 percent distribution yield, which is higher than equity alternatives such as REITs and Utilities." The fund is a part of the SteelPath Mutual Fund Family. On August 25, 2010, the first MLP exchange traded fund (ETF) was launched by Alerian, the company that manages the benchmark MLP index (NYSE: ^AMZ). This fund was similarly designed to the above mentioned mutual fund in that it avails a new level of diversification to investors, as well as, according to Alerian President Kenny Feng, "provides a single Form 1099, no K-1s, and allows investors to potentially benefit from return of capital and qualified dividend tax treatment of distributions." The fund is known as the Alerian MLP ETF (NYSE: AMLP).

Some private equity management companies such as Blackstone Group (NYSE: BX) and Fortress Investment Group (NYSE: FIG) are structured as MLPs.

In practice, MLPs pay their investors through quarterly required distributions (QRD), the amount of which is stated in the contract between the limited partners (the investors) and the general partner (the managers or GP). Typically, the higher the quarterly distributions paid to LP unitholders, the higher the management fee paid to the GP. The idea is that the GP has an incentive to try to boost distributions through pursuing income-accretive acquisitions and organic growth projects. Failure to pay the QRD may constitute an event of default.

Because of such stringent provisions on MLPs, and the nature of the QRD, the vast majority of MLPs are pipeline businesses, which earn very stable income from the transport of oil, gasoline or natural gas.

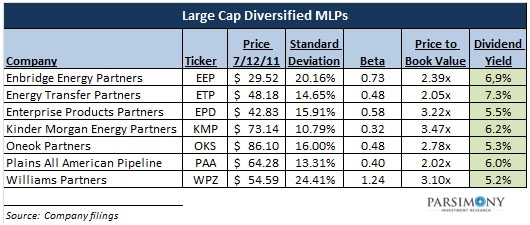

Kinder Morgan Energy Partners, |  Kinder Morgan Energy |  That alone makes Kinder Morgan |  Energy Transfer Partners |  kinder-morgan-purchasing- |

Kinder Morgan Energy | is Kinder Morgan Energy |  that Kinder Morgan Energy | Kinder Morgan Energy | Kinder Morgan Energy |

An example is the pipeline company Kinder Morgan Energy Partners. The main corporation, Knight, Inc. (formerly traded on the NYSE as KMI), is the operator of the pipelines and other assets. However, the pipelines themselves are owned by the MLP Kinder Morgan Energy Partners, L.P. (NYSE:KMP). Finally, part of KMP's limited partner interests are held by the corporation Kinder Morgan Management LLC (NYSE:KMR) which allows tax-deferred investors to participate in KMP's operations.

Constellation Energy Partners |  by *Kinder Morgan Energy |  Kinder Morgan To Pay |  Kelsey Grammer\x26#39;s wife Camille |  Kelsey Grammer, Wife #4 |

wife of Kelsey Grammer, |  Kelsey Grammer and his wife |  Kelsey Grammer\x26#39;s Wife: GM BAG |  Kelsey Grammer and wife |  Kelsey Grammer, Wife Split |

No comments:

Post a Comment